home

& kitchen

For over 100 years, Westinghouse has brought the best to your home. See our wide selection of products.

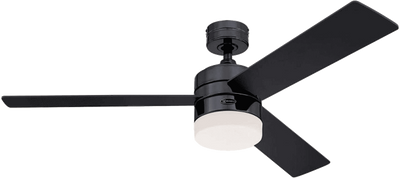

patio

& outdoor

Power to cultivate and maintain your homes surroundings backed by a century of innovation.

electronics

Surround yourself with the sights and sounds of innovation. Explore our vast variety of home and portable electronics.

industrial

Power components including circuit protection, switching, & motor controls.